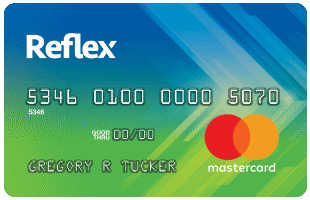

Rebuild your credit with the Reflex Credit Card! Limits from $300 to $1,000

Take control of your financial future with the Reflex Credit Card. Limits from $300 to $1,000

Anúncios

Struggling with bad credit? The Reflex Credit Card is here to help. With credit limits ranging from $300 to $1,000, it’s the perfect tool to rebuild your financial health. No more embarrassment or stress – take control of your life and watch your credit score rise. Apply now for the Reflex Credit Card and start your journey towards financial freedom!

Struggling with bad credit? The Reflex Credit Card is here to help. With credit limits ranging from $300 to $1,000, it’s the perfect tool to rebuild your financial health. No more embarrassment or stress – take control of your life and watch your credit score rise. Apply now for the Reflex Credit Card and start your journey towards financial freedom!

Você permanecerá no mesmo site

Discover the many benefits of the Reflex Credit Card by reading on. Take the first step towards rebuilding your credit and regaining your financial independence.

Você permanecerá no mesmo site

The Reflex Credit Card is a credit card specifically designed for individuals with poor or limited credit histories. It offers an opportunity for those with bad credit to access credit and work towards improving their credit score.

The Reflex Credit Card typically provides a credit limit ranging from $300 to $1,000. The specific limit you receive will depend on factors such as your creditworthiness, income, and other financial considerations.

You can apply for the Reflex Credit Card online through the issuer’s website. The application process typically involves providing personal information, financial details, and consent for a credit check.

No, the Reflex Credit Card does not usually require a security deposit. Unlike secured credit cards, where you have to provide a deposit as collateral, the Reflex Card is an unsecured credit card. However, it’s important to note that unsecured cards for bad credit often come with higher interest rates and fees.

Yes, using the Reflex Credit Card responsibly can help improve your credit score over time. By making timely payments, staying within your credit limit, and managing your card responsibly, you can demonstrate positive credit behavior to credit reporting agencies.

Yes, like many credit cards for bad credit, the Reflex Card may have certain fees, such as an annual fee and possibly other charges. It’s important to review the terms and conditions before applying to understand the full fee structure.

Yes, some issuers of credit cards for bad credit offer opportunities to upgrade to better cards as your credit score improves.

Em Alta

Apply now for your Chase Freedom℠ with credit limit up to $2,500!

Experience the ultimate flexibility with Chase Freedom Flex. Earn cashback on a wide range of purchases, enjoy 0% introductory APR.

Continue lendo

Aluguel Social – Conheça esse benefício!

O Aluguel Social é um auxílio para famílias que se encontram em vulnerabilidade social. Saiba mais sobre esse benefício.

Continue lendo

Confira tudo sobre aplicativos de diagnóstico e reparo automotivo

Descubra o futuro da manutenção de carros com o aplicativo de reparo automotivo. Economize tempo e dinheiro ao identificar!

Continue lendoVocê também pode gostar

Como comprar passagens na Azul a partir de R$139,90

A Azul ta com descontos incriveis pra você que topa viajar de madrugada pagando pouco. Vôos a partir de R$139,90!

Continue lendo

Gol Smiles: Viaje pagando pouco para qualquer lugar do mundo

Imagine voar para o seu destino dos sonhos usando milhas acumuladas em suas viagens! Com o Gol Smiles, isso é possível!

Continue lendo

Adquira suas passagens na LATAM cheias de vantagens desde R$ 361,90

Voar com passagens na LATAM é sinônimo de conforto, segurança e economia. Aproveite as incríveis tarifas a partir de R$ 361,90!

Continue lendo